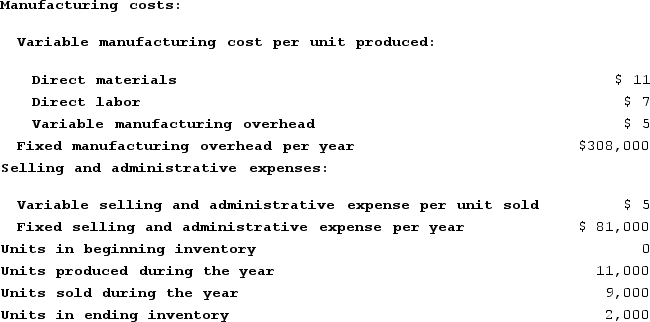

Simila Corporation has provided the following data for its most recent year of operation:  Which of the following statements is true?

Which of the following statements is true?

Definitions:

Product Warranty Expense

The cost associated with the obligation of a company to repair or replace defective products sold to customers, recognized as a liability.

Social Security Tax Rate

The Social Security tax rate is a percentage of income that is taxed to fund the Social Security program, paid by both employees and employers.

Medicare Tax Rate

The percentage of an employee's earnings that is withheld by the employer to contribute to the U.S. Medicare program, which provides health insurance to eligible individuals.

Federal Unemployment Compensation Tax

A tax imposed on employers to fund the federal government's oversight of the state unemployment insurance programs.

Q4: The following data are available for the

Q29: Wyrich Corporation has two divisions: Blue Division

Q59: Gulinson Corporation has two divisions: Division A

Q122: Bries Corporation is preparing its cash budget

Q179: Duve Corporation has provided the following contribution

Q213: Desjarlais Corporation uses the following activity rates

Q229: Porter Corporation makes and sells a single

Q282: Tremble Corporation manufactures and sells one product.

Q313: Neef Corporation has provided the following data

Q353: Columbia Corporation produces a single product. The