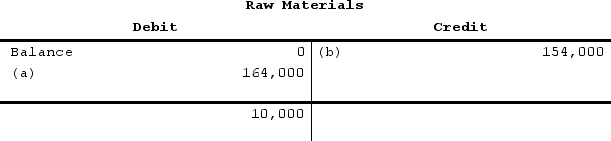

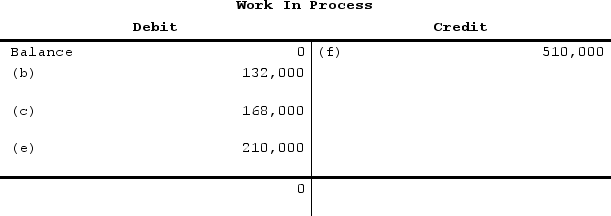

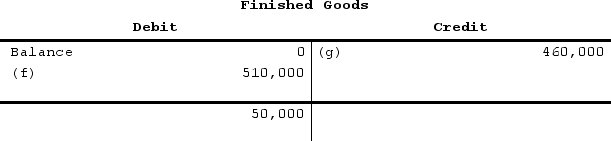

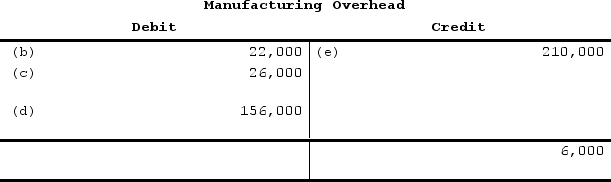

The following accounts are from last year's books of Sharp Manufacturing:

Definitions:

Payroll Tax Expense

Taxes that are incurred by an employer based on the salaries and wages of employees, including taxes like Social Security and Medicare in the United States.

FICA

The Federal Insurance Contributions Act tax is a United States federal payroll tax imposed on both employees and employers to fund Social Security and Medicare.

SUTA

State Unemployment Tax Act; a tax paid by employers at a state level to fund unemployment benefits for workers who lose their jobs.

FUTA

The Federal Unemployment Tax Act, which imposes a payroll tax on businesses to fund state workforce agencies.

Q34: Petty Corporation has two production departments, Milling

Q40: In February, one of the processing departments

Q56: Sivret Corporation uses a job-order costing system

Q78: Daget Corporation uses direct labor-hours in its

Q205: In February, one of the processing departments

Q217: Spang Corporation uses a job-order costing system

Q282: Dorman Music Corporation manufactures guitars and uses

Q302: Rieb Inc. has provided the following data

Q303: Comans Corporation has two production departments, Milling

Q343: Kalp Corporation has two production departments, Machining