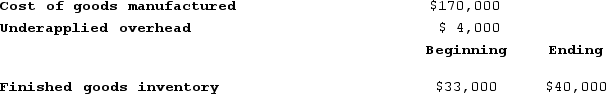

Gurtner Corporation has provided the following data concerning last month's operations.  Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

Definitions:

Interfirm Comparisons

The analysis and evaluation of a company's performance or financial health in relation to its competitors or industry standards.

Deferred Tax Asset

An item on a company’s balance sheet that represents the difference in timing between when a tax is accrued and when it is paid, potentially reducing future tax liability.

Tax Rate Change

An alteration in the percentage at which an individual or corporation is taxed, which can affect financial planning and net income.

Temporary Difference

A difference between the carrying amount of an asset or liability in the balance sheet and its tax base that will result in taxable or deductible amounts in future years.

Q17: The management of Buelow Corporation would like

Q99: Solt Corporation uses a job-order costing system

Q119: Plasencia Corporation is a manufacturer that uses

Q163: Danaher Woodworking Corporation produces fine furniture. The

Q203: The Thomas Corporation has two service departments

Q203: The following partially completed T-accounts summarize transactions

Q289: Acheson Corporation, which applies manufacturing overhead on

Q299: Henkes Corporation bases its predetermined overhead rate

Q364: Ahlheim Corporation has two production departments, Forming

Q383: Prather Corporation uses a job-order costing system