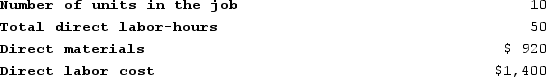

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:  The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

Definitions:

Factory Overhead

Factory overhead encompasses all the indirect costs associated with manufacturing, such as utilities, maintenance, and salaries of non-direct labor.

Assemblers Wages

The compensation paid to workers who are responsible for piecing together components to form a finished product.

Direct Labor

The cost of wages for employees who are directly involved in the production of goods or services, considered a variable cost in financial accounting.

Direct Materials

This refers to raw materials that are directly incorporated into a finished product during the manufacturing process.

Q54: A step-variable cost is a cost that

Q59: Coudriet Manufacturing Corporation has a traditional costing

Q60: Job 652 was recently completed. The following

Q69: Coudriet Manufacturing Corporation has a traditional costing

Q85: Verrett Corporation is a manufacturer that uses

Q125: Hardigree Corporation uses a job-order costing system.

Q126: Purves Corporation is using a predetermined overhead

Q155: Glew Corporation has provided the following information:

Q214: The following partially completed T-accounts are for

Q361: Decorte Corporation uses a job-order costing system