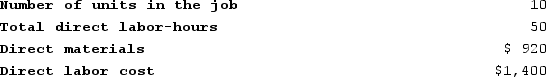

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:  If the company marks up its unit product costs by 40% then the selling price for a unit in Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Franchise Arrangements

Agreements where one party (the franchisor) grants another party (the franchisee) the right to use its trademark or brand name and operate a business under its business model.

Exclusive Right

A legal provision granting someone the sole authority to undertake a particular activity or use a specific property.

Franchisor's Name

The legal name of the entity that grants the license to a franchisee for the conducting of a business under the franchisor's trademarks and business model.

Installment Sales Method

An accounting technique for recognizing revenue and expenses for sales made on credit, proportionate to the cash collected from the customer.

Q1: Easy Incorporated uses the first-in, first-out method

Q66: Contribution format income statements are prepared primarily

Q101: The following partially completed T-accounts summarize transactions

Q112: The following partially completed T-accounts summarize transactions

Q169: Selling and administrative expenses are period costs

Q242: Levron Corporation uses a job-order costing system

Q303: Comans Corporation has two production departments, Milling

Q340: Sparacino Corporation has provided the following information:

Q351: Coble Woodworking Corporation produces fine cabinets. The

Q363: The management of Plitt Corporation would like