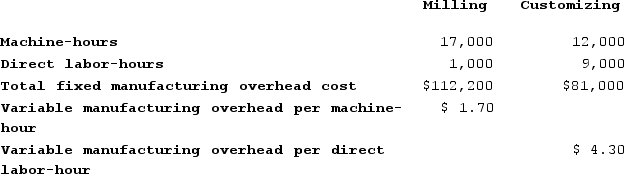

Kroeker Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T898. The following data were recorded for this job:

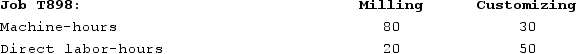

During the current month the company started and finished Job T898. The following data were recorded for this job: The amount of overhead applied in the Customizing Department to Job T898 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job T898 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Four Pinions

Describes a gear assembly configuration that includes four pinion gears, often found in differential assemblies to evenly distribute torque to the wheels.

Truck Differential

A mechanical device in a truck that allows the outer drive wheel to rotate faster than the inner drive wheel during a turn, improving traction and handling.

Tandem Drive Truck

A truck with two rear axles, both of which are drive axles, providing better traction and load distribution.

Spinout

Occurs when differential action allows one drive wheel on a slippery surface to spin while the other remains stationary and receives no driving torque. On tandem drive trucks, because of the additional differential action between the drive axles, it is possible to turn a spinning wheel at four times its normal speed. This can take out the interaxle differential or carrier differential. Spinout is a driver abuse failure of differential carriers.

Q4: Kostelnik Corporation uses a job-order costing system

Q5: Acheson Corporation, which applies manufacturing overhead on

Q57: Abburi Company's manufacturing overhead is 55% of

Q94: Job 910 was recently completed. The following

Q111: Stockman Incorporated has provided the following data

Q142: Franta Corporation uses a job-order costing system

Q161: Emigh Corporation's cost of goods manufactured for

Q182: Harnett Corporation has two manufacturing departments--Molding and

Q184: Paolucci Corporation's relevant range of activity is

Q187: Able Corporation uses a job-order costing system.