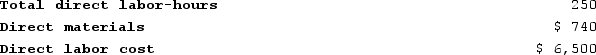

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 20,000 direct labor-hours, total fixed manufacturing overhead cost of $182,000, and a variable manufacturing overhead rate of $2.50 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.)

Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.)

Definitions:

Accounting Period

A time frame for which financial statements are prepared, typically a year, quarter, or month, to measure a company's financial performance.

Other Expenses

Costs that do not directly relate to the main business activities, such as administrative and organizational expenses.

Unrealized Loss Account

An account that reflects losses which have occurred on paper due to changes in market values but have not been actually realized through a transaction.

Short-Term Stock Investments

Investments in stock intended to be held for a short duration, typically less than one year, for earning a quick profit.

Q66: Contribution format income statements are prepared primarily

Q92: At a sales volume of 20,000 units,

Q143: During December, Moulding Corporation incurred $76,000 of

Q150: Which of the following statements is true

Q184: Paolucci Corporation's relevant range of activity is

Q195: Lagle Corporation has provided the following information:

Q231: Selling costs are indirect costs.

Q238: Koelsch Corporation has two manufacturing departments--Molding and

Q296: Bulla Corporation has two production departments, Machining

Q384: Coble Woodworking Corporation produces fine cabinets. The