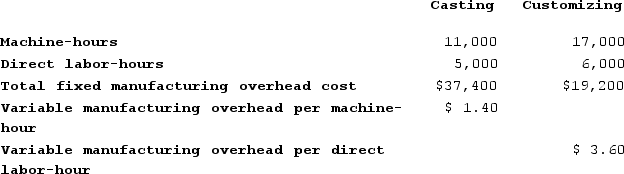

Garza Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The estimated total manufacturing overhead for the Customizing Department is closest to:

The estimated total manufacturing overhead for the Customizing Department is closest to:

Definitions:

Current Account

The section in a nation’s international balance of payments that records its exports and imports of goods and services, its net investment income, and its net transfers.

Investment Income

Income earned from the investment of capital in assets such as stocks, bonds, real estate, or other investment vehicles.

Dollar/Yen Market

The foreign exchange market involving the trading of US dollars and Japanese yen.

Appreciate

To increase in value or price, often in the context of financial investments or currency valuations.

Q3: Rist Corporation uses a predetermined overhead rate

Q80: Placker Corporation uses a job-order costing system

Q122: Lupo Corporation uses a job-order costing system

Q125: In a traditional format income statement for

Q143: At a sales volume of 20,000 units,

Q193: Boersma Sales, Incorporated a merchandising company, reported

Q212: The management of Bullinger Corporation would like

Q273: Karpowicz Corporation's relevant range of activity is

Q292: Tiff Corporation has two production departments, Casting

Q302: Skolnick Corporation has provided the following information:<br>