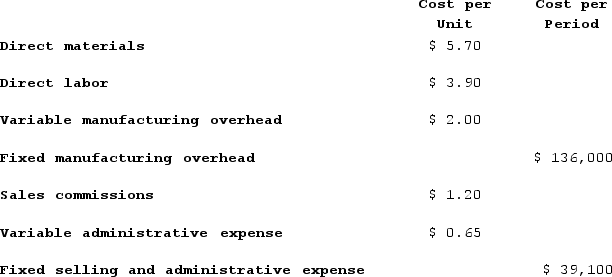

Skolnick Corporation has provided the following information:

Required:a. If 8,500 units are produced, what is the total amount of direct manufacturing cost incurred? (Do not round intermediate calculations.)b. If 8,500 units are produced, what is the total amount of indirect manufacturing costs incurred?

Required:a. If 8,500 units are produced, what is the total amount of direct manufacturing cost incurred? (Do not round intermediate calculations.)b. If 8,500 units are produced, what is the total amount of indirect manufacturing costs incurred?

Definitions:

Inventory method

An accounting approach used to value and manage the inventory of a business, including FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and average cost methods.

Updated inventory value

The revised total cost or market value of all inventory items a company holds, adjusted for additions, subtractions, and valuation changes over a specific period.

LIFO method

Last In, First Out; an inventory valuation method where the most recently produced or purchased items are the first to be expensed.

Periodic system

An inventory valuation method where updates to inventory records are made on a periodic basis, usually at the end of an accounting period.

Q3: Mayfield Corporation has provided the following financial

Q45: Cost behavior is considered curvilinear whenever a

Q48: Hyrkas Corporation's most recent balance sheet and

Q124: Luarca Corporation has two manufacturing departments--Casting and

Q134: McCorey Corporation recorded the following events last

Q163: Walmouth Corporation's comparative balance sheet and income

Q180: Tani Corporation's most recent balance sheet appears

Q249: If a retailer sells a product whose

Q308: The management of Plitt Corporation would like

Q314: Vignana Corporation manufactures and sells hand-painted clay