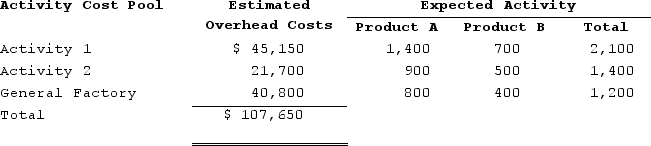

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 2,000 units of Product A and 2,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $107,650.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.) The overhead cost per unit of Product B under the activity-based costing system is closest to:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.) The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Partnership Creation

The formation of a partnership through the agreement of two or more individuals to carry on a business for profit as co-owners.

Accounting Partnership

A business arrangement where two or more individuals practice accounting together, sharing responsibilities, profits, and liabilities.

Legal Position

indicates an individual's or entity's standing or status in relation to the law, including rights, obligations, or liabilities.

Partnership

A business structure in which two or more individuals manage and operate a business in accordance with terms and objectives set out in a Partnership Agreement.

Q2: Bolander Corporation uses a job-order costing system

Q81: Rhome Corporation's relevant range of activity is

Q106: Bottum Corporation, a manufacturing Corporation, has provided

Q123: Pedregon Corporation has provided the following information:

Q217: Dagostino Corporation uses a job-order costing system.

Q240: Most companies use the contribution approach in

Q292: Tiff Corporation has two production departments, Casting

Q309: Tyare Corporation had the following inventory balances

Q315: Pedregon Corporation has provided the following information:

Q383: Prather Corporation uses a job-order costing system