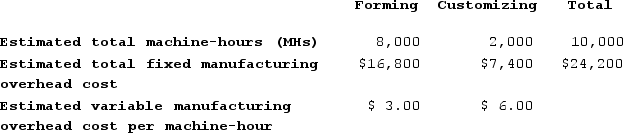

Hultquist Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead rates:

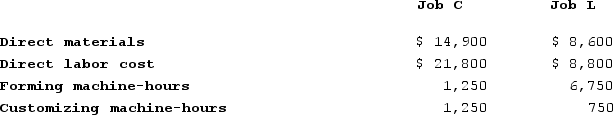

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Definitions:

Discounted Payback Period

The time required to recover the cost of an investment while considering the time value of money.

Initial Investment

The amount of money used to start an investment project or venture.

Mutually Exclusive

A situation where the occurrence of one event means the other cannot occur at the same time.

Q65: Teasley Corporation uses a job-order costing system

Q79: Gurtner Corporation has provided the following data

Q82: Fixed costs expressed on a per unit

Q118: ErkkilaIncorporated reports that at an activity level

Q124: Adens Corporation's relevant range of activity is

Q184: Camm Corporation has two manufacturing departments--Forming and

Q196: Deloria Corporation has two production departments, Forming

Q239: Dotsero Technology, Inc., has a job-order costing

Q248: The management of Holdaway Corporation would like

Q297: Dowty Woodworking Corporation produces fine cabinets. The