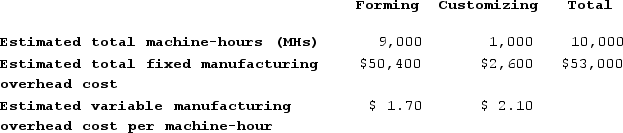

Hultquist Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead rates:

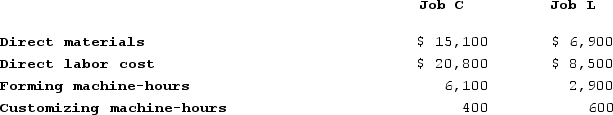

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Capital Structure

The mix of debt and equity financing a company uses to fund its operations and growth, affecting its risk profile and cost of capital.

MCC Curve

Stands for the Marginal Cost of Capital Curve, representing the cost of obtaining one more unit of capital.

Dividends

Funds distributed by a company to its shareholders, representing a share of the company's earnings.

Q67: If current assets exceed current liabilities, prepaying

Q82: Moscone Corporation bases its predetermined overhead rate

Q83: The following partially completed T-accounts are for

Q141: All other things the same, if long-term

Q156: Hunkins Corporation has provided the following data

Q185: Lueckenhoff Corporation uses a job-order costing system

Q199: Conversion cost is the sum of direct

Q251: Harris Corporation, a retailer, had cost of

Q277: Claybrooks Corporation has two manufacturing departments--Casting and

Q314: Garza Corporation has two production departments, Casting