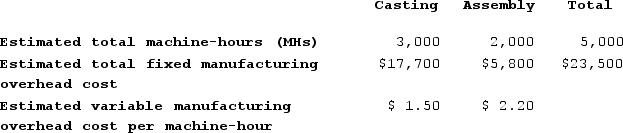

Claybrooks Corporation has two manufacturing departments--Casting and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Assembly Department is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Assembly Department is closest to:

Definitions:

Record Transaction

Recording transactions refers to the process of documenting financial transactions in the appropriate books of accounts as they occur, ensuring accurate financial records.

Salary Allowances

Pre-determined sums paid to employees over their regular salary, allocated for specific purposes such as transportation, housing, or meals.

Income Distribution

The process by which earned income is distributed among various stakeholders, including dividends to shareholders and payments to other entities.

Q3: Kesterson Corporation has provided the following information:

Q31: A factory supervisor's wages are classified as:

Q87: Adelberg Corporation makes two products: Product A

Q94: Saint Johns Corporation uses a job-order costing

Q197: Bolander Corporation uses a job-order costing system

Q215: The term that refers to costs incurred

Q293: Coble Woodworking Corporation produces fine cabinets. The

Q294: Comans Corporation has two production departments, Milling

Q321: In determining whether a company's financial condition

Q329: The management of Plitt Corporation would like