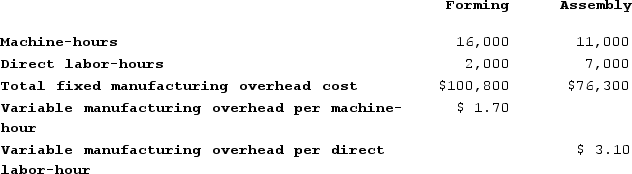

Gercak Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

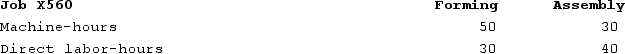

During the current month the company started and finished Job X560. The following data were recorded for this job:

During the current month the company started and finished Job X560. The following data were recorded for this job:

Required:a. Calculate the estimated total manufacturing overhead for the Assembly Department.b. Calculate the predetermined overhead rate for the Forming Department.c. Calculate the total amount of overhead applied to Job X560 in both departments.

Required:a. Calculate the estimated total manufacturing overhead for the Assembly Department.b. Calculate the predetermined overhead rate for the Forming Department.c. Calculate the total amount of overhead applied to Job X560 in both departments.

Definitions:

Q11: To increase total asset turnover, management must

Q33: The management of Featheringham Corporation would like

Q44: An income statement for Sam's Bookstore for

Q80: Boursaw Corporation has provided the following data

Q84: Lotz Corporation has two manufacturing departments--Casting and

Q172: Rondo Corporation uses a job-order costing system

Q183: Dancel Corporation has two production departments, Milling

Q200: Schwiesow Corporation has provided the following information:

Q287: Kesterson Corporation has provided the following information:

Q348: Adelberg Corporation makes two products: Product A