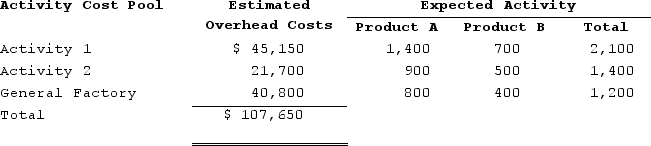

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 2,000 units of Product A and 2,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $107,650.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.) The overhead cost per unit of Product B under the activity-based costing system is closest to:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.) The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Means-tested

A method of determining eligibility for certain forms of financial aid or social services that is based on the applicant's income and assets.

In-kind Benefit

Non-monetary goods or services provided to individuals in need, such as food assistance, housing, or healthcare, instead of cash payments.

Welfare Program

Governmental provisions designed to support the well-being of its citizens, particularly those in financial or social need.

Income Distribution

The way in which total income is shared among the population.

Q27: Lupo Corporation uses a job-order costing system

Q145: Tyare Corporation had the following inventory balances

Q186: The following partially completed T-accounts summarize transactions

Q187: At an activity level of 6,800 units,

Q196: Product costs that have become expenses can

Q205: Sutter Corporation uses a job-order costing system

Q206: Trevigne Corporation uses a predetermined overhead rate

Q232: Kalp Corporation has two production departments, Machining

Q248: The management of Holdaway Corporation would like

Q274: Schwiesow Corporation has provided the following information: