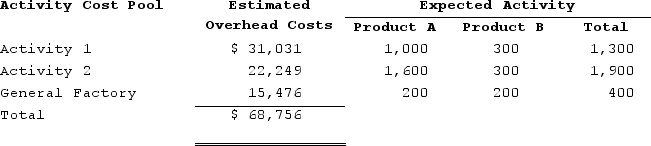

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Epigenetic

Relating to the study of changes in organisms caused by modification of gene expression rather than alteration of the genetic code itself.

Environmental Forces

Various external factors such as climate, geography, and human activities that influence ecosystems and the organisms within them.

Plastic

Plastic is a synthetic material made from a wide range of organic polymers, such as polyethylene and PVC, that can be molded into shape while soft and then set into a rigid or slightly elastic form.

Psychoanalytic Theory

A psychological theory originated by Sigmund Freud that emphasizes the importance of unconscious processes in shaping behavior and personality.

Q10: Baka Corporation applies manufacturing overhead on the

Q18: The management of Featheringham Corporation would like

Q68: Baab Corporation is a manufacturing firm that

Q111: The management of Winterroth Corporation would like

Q153: Deloria Corporation has two production departments, Forming

Q155: Levron Corporation uses a job-order costing system

Q209: Bressette Corporation has provided the following information:

Q298: Centore Incorporated has provided the following data

Q335: Prime cost consists of:<br>A) direct labor and

Q405: Dunnings Woodworking Corporation produces fine cabinets. The