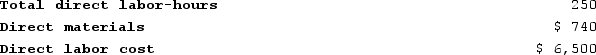

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 20,000 direct labor-hours, total fixed manufacturing overhead cost of $182,000, and a variable manufacturing overhead rate of $2.50 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.)

Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.)

Definitions:

Flextime Program

A flexible working hours scheme that allows employees to alter their start and finish times, within certain limits, to suit their personal commitments and needs.

Specified Limits

Predetermined boundaries or constraints that define the scope, actions, or conditions under which a process or operation can occur.

Employee Retention

Strategies and practices employed by organizations to prevent valuable employees from leaving their jobs.

Engagement Level

The degree of enthusiasm and dedication an employee exhibits toward their job and the organization they work for.

Q12: The costs attached to products that have

Q13: Glew Corporation has provided the following information:

Q134: Centore Incorporated has provided the following data

Q231: Kalp Corporation has two production departments, Machining

Q308: The formula for the net profit margin

Q322: Which of the following is unlikely to

Q332: Kroeker Corporation has two production departments, Milling

Q336: Coble Woodworking Corporation produces fine cabinets. The

Q340: Kreuzer Corporation is using a predetermined overhead

Q386: Comans Corporation has two production departments, Milling