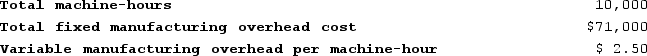

Ryans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

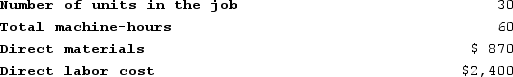

Recently Job P512 was completed with the following characteristics:

Recently Job P512 was completed with the following characteristics:

Required:a. Calculate the predetermined overhead rate for the year.b. Calculate the amount of overhead applied to Job P512.c. Calculate the total job cost for Job P512.d. Calculate the unit product cost for Job P512.

Required:a. Calculate the predetermined overhead rate for the year.b. Calculate the amount of overhead applied to Job P512.c. Calculate the total job cost for Job P512.d. Calculate the unit product cost for Job P512.

Definitions:

FICA Taxes

FICA taxes are federal payroll taxes collected to fund Social Security and Medicare, divided into equal parts paid by employers and employees.

Student Loan Interest

The cost incurred from borrowing funds for education, which can often be deducted from taxable income under certain conditions in many tax jurisdictions.

Deduction Limit

The maximum amount that can be subtracted from taxable income for certain expenses, beyond which deductions are no longer permitted or are reduced.

Tax Year

The 12-month period for which tax is calculated, often either the calendar year or a fiscal year established by a business.

Q8: Pedregon Corporation has provided the following information:

Q9: Blasi Corporation is a manufacturer that uses

Q80: Placker Corporation uses a job-order costing system

Q155: Glew Corporation has provided the following information:

Q168: Meenach Corporation uses a job-order costing system

Q182: Leak Enterprises LLC recorded the following transactions

Q189: Most countries require some form of absorption

Q222: Vogel Corporation's cost of goods manufactured last

Q309: Lupo Corporation uses a job-order costing system

Q392: The management of Schneiter Corporation would like