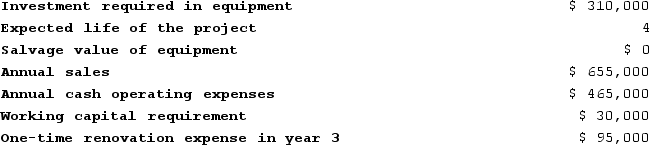

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

Definitions:

Note

A written promise to pay a specified amount of money at a certain time, often used in finance as a type of informal loan agreement or debt instrument.

Nonnegotiable

indicates an item that cannot be transferred or assigned to another party through endorsement or delivery.

Purchase Price

The amount of money paid or to be paid by the buyer to acquire ownership of a good, service, or property.

Federal Law

Legislation enacted by the national government of a country; in the United States, laws passed by Congress and signed by the President.

Q28: Waltermire Corporation has provided the following information

Q61: If the net present value of a

Q85: In the statement of cash flows, collecting

Q121: Lambert Manufacturing has $120,000 to invest in

Q155: Financial statements for Rardin Corporation appear below:<br>

Q209: The following information concerning a proposed capital

Q215: Belk Corporation's balance sheet appears below:<br> <img

Q220: Supler Corporation produces a part used in

Q252: Lindboe Corporation has provided the following financial

Q255: Mondok Corporation has provided the following financial