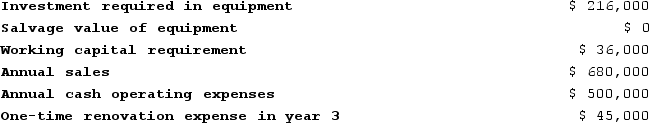

The following information concerning a proposed capital budgeting project has been provided by Jochum Corporation:Click here to viewExhibit 14B-1 to determine the appropriate discount factor(s) using tables.  The expected life of the project is 4 years. The income tax rate is 30%. The after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $54,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

The expected life of the project is 4 years. The income tax rate is 30%. The after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $54,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

Definitions:

Experimental Group

In research, a group of subjects who are exposed to the variable under investigation, as opposed to the control group which is not.

Comparisons

The act of evaluating two or more items to highlight their similarities and differences.

Deception

The extent to which the participants in a research project are unaware of the project or its goals.

Reactivity

The tendency of people and events to react to the process of being studied.

Q27: Symons Corporation has provided the following financial

Q36: The management of Bonga Corporation is considering

Q103: The following data pertain to an investment

Q109: When computing the net cash provided by

Q166: Data from Dalpiaz Corporation's most recent balance

Q176: Shimko Corporation's most recent comparative balance sheet

Q261: Maurer Corporation is considering a capital budgeting

Q274: Cranston Corporation makes four products in a

Q287: In the absorption approach to cost-plus pricing,

Q329: Rhoads Corporation is considering a capital budgeting