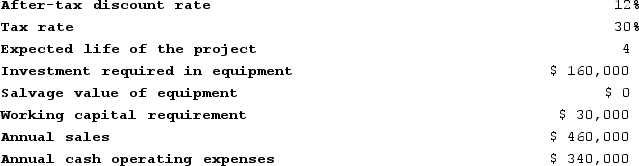

Waltermire Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

Definitions:

Lateral Blast

A volcanic eruption characterized by the powerful, horizontal expulsion of ash, gas, and volcanic debris, often occurring with little to no warning.

Mount St. Helens

An active stratovolcano located in Washington State, USA, famous for its catastrophic eruption on May 18, 1980.

Steep-Sided Cone

A type of volcanic mountain with steep sides, typically formed from eruptions that deposit large amounts of volcanic material around the vent.

Composite Volcano

A volcano known for its explosive outbursts, made up of alternating strata of ash and lava.

Q25: Nessen Corporation has provided the following information

Q58: Marbry Corporation has provided the following information

Q109: The Wester Corporation produces three products with

Q125: Houze Corporation has provided the following information

Q130: Slomkowski Corporation is contemplating purchasing equipment that

Q138: During the year the balance in the

Q174: Jarvey Corporation is studying a project that

Q230: Accepting a special order will improve overall

Q306: Shilt Corporation is considering a capital budgeting

Q366: The management of Penfold Corporation is considering