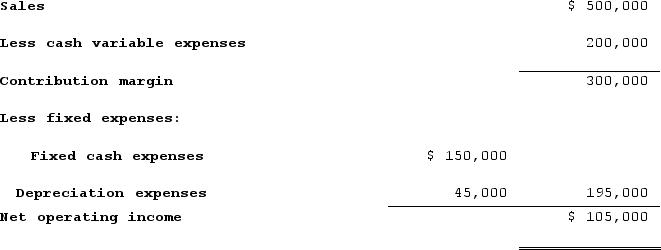

Jarvey Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (Ignore income taxes.) :  The company's required rate of return is 12%. The payback period for this project is closest to:

The company's required rate of return is 12%. The payback period for this project is closest to:

Definitions:

Quantity Supplied

The total amount of a good or service that producers are willing and able to sell at a given price over a specific period of time.

U.S. Tariff

A tax imposed by the United States government on imported goods and services, intended to protect domestic industries and generate revenue.

Steel

A strong, hard metal made of iron and carbon, and often other elements, used extensively in construction and manufacturing.

Domestic Quantity

The total amount of a good or service produced within a country's borders, available for consumption or export.

Q77: Future costs that do not differ between

Q115: Annala Corporation is considering a capital budgeting

Q127: Ouzts Corporation is considering Alternative A and

Q186: Clayborn Corporation's net cash provided by operating

Q279: Data from Dunshee Corporation's most recent balance

Q312: If investment funds are limited, the net

Q321: "Cost-plus" pricing means that all costs--manufacturing, selling,

Q354: Puello Corporation has provided the following data

Q370: Respass Corporation has provided the following data

Q381: Basey Corporation has provided the following data