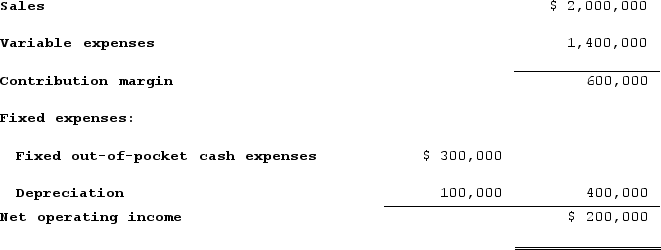

Ursus, Incorporated, is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.):

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:a. Compute the project's net present value.b. Compute the project's internal rate of return to the nearest whole percent.c. Compute the project's payback period.d. Compute the project's simple rate of return.

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:a. Compute the project's net present value.b. Compute the project's internal rate of return to the nearest whole percent.c. Compute the project's payback period.d. Compute the project's simple rate of return.

Definitions:

Misleading

Describing information or representations that give a wrong idea or impression, potentially leading to misunderstandings or incorrect conclusions.

Biased

Showing an unjustifiable favor towards something or someone based on personal opinion rather than facts.

Intellectual Property Rights

Legal rights granted to creators and owners over their inventions, works, symbols, and names, for a certain period of time.

Artist's

Related to or characteristic of an artist, including aspects of creativity, style, or artwork.

Q21: Crossland Corporation reported sales on its income

Q54: Kinsley Corporation manufactures numerous products, one of

Q107: (Ignore income taxes in this problem.) Bradley

Q168: The changes in Northrup Corporation's balance sheet

Q191: The management of an amusement park is

Q200: Comparative balance sheets and the income statements

Q249: Avoidable costs are irrelevant costs in decisions.

Q344: Management of Thebeau, Incorporated, is considering a

Q356: Consider the following three investment opportunities:Project I

Q415: Demand for a product is said to