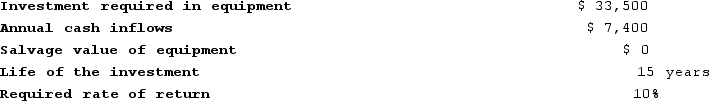

Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.) :  The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.The internal rate of return of the investment is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.The internal rate of return of the investment is closest to:

Definitions:

Earnings Retention Ratio

A financial metric indicating the percentage of a company's net earnings that is not paid out as dividends, but instead retained for reinvestment.

Excluding Growth Opportunities

The omission or overlooking of potential future projects or investments that could lead to an increase in company value.

ROE

Return on Equity is a measure of a company's profitability relative to shareholders' equity.

Expected Earnings

The forecasted income of a company, often used by investors to gauge future profitability.

Q33: Fayer Corporation has provided the following financial

Q45: Sales reported on the income statement totaled

Q56: Last year, Knox Corporation reported on its

Q57: Part U16 is used by Mcvean Corporation

Q64: Padmore Corporation has provided the following information

Q65: Free cash flow is net cash provided

Q270: The management of Bonga Corporation is considering

Q275: A capital budgeting project's incremental net income

Q285: Fixed costs are sunk costs.

Q329: In a special order situation that involves