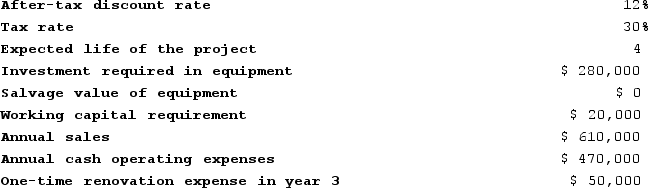

Eison Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment.The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment.The income tax expense in year 3 is:

Definitions:

Macrophages

A kind of leukocyte that consumes and breaks down cellular waste, foreign materials, microorganisms, and cancerous cells through a mechanism known as phagocytosis.

Immune System

The complex network of cells, tissues, and organs that work together to defend the body against attacks by foreign invaders, such as bacteria, viruses, and cancer cells.

Carcinogens

Substances or exposures that are capable of causing cancer in living organisms.

Lymphocytes

A type of white blood cell in the immune system consisting of natural killer cells, T cells, and B cells, which are central to adaptive immunity and protecting the body against pathogens.

Q38: The management of Musselman Corporation would like

Q45: Bruce Corporation makes four products in a

Q55: Marbry Corporation has provided the following information

Q135: Sharp Corporation produces 8,000 parts each year,

Q142: In an effort to reduce costs, Pontic

Q150: Kaze Corporation's cash and cash equivalents consist

Q156: Beltram Corporation's balance sheet and income statement

Q218: Walmouth Corporation's comparative balance sheet and income

Q272: An investment project with a profitability index

Q363: A shorter payback period does not necessarily