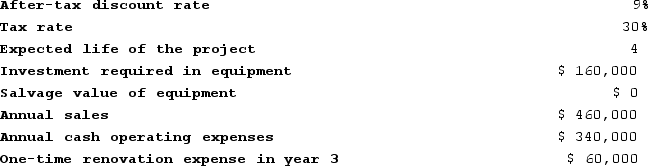

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

Definitions:

Synapomorphy

A trait that is shared by two or more taxa and their most recent common ancestor, used to infer evolutionary relationships.

Phylogenetic Methods

Techniques used in biology to infer the evolutionary relationships and history among different species or genes.

Partner-Partner Transmission

The spread of a pathogen or disease between individuals in a close relationship, typically referring to sexually transmitted infections.

Cohort

A group of individuals of the same age within a population, tracked over a period of time for epidemiological or statistical analysis.

Q5: Glover Company makes three products in a

Q21: The Melville Corporation produces a single product

Q33: Reven Corporation prepares its statement of cash

Q51: The management of Rademacher Corporation is considering

Q72: Mcelveen Corporation has provided the following information

Q134: In calculating the payback period where new

Q154: Cabe Corporation uses a discount rate of

Q179: Megan Corporation's net income last year was

Q188: Negative free cash flow suggests that the

Q390: Mcniff Corporation makes a range of products.