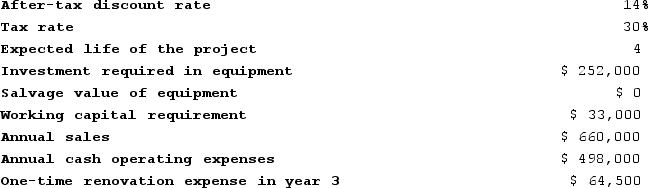

Dobrinski Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

Definitions:

Transformational Leadership

A leadership style that inspires and motivates followers to exceed expectations by focusing on higher-order intrinsic needs and fostering significant changes within an organization or society.

Charisma

A compelling attractiveness or charm that can inspire devotion in others, often seen as an innate quality that makes someone a natural leader.

Human Factors Psychology

A field that applies psychological and physiological principles to the engineering and design of products, processes, and systems, enhancing human usability and performance.

360-degree Feedback

A performance appraisal method where an employee is evaluated by feedback from various sources including peers, supervisors, subordinates, and sometimes, customers.

Q11: Klutz Dance Studio had net income of

Q17: Megan Corporation's net income last year was

Q22: McCrohan Corporation is considering a capital budgeting

Q28: Medina Corporation has provided the following financial

Q54: Kinsley Corporation manufactures numerous products, one of

Q156: Beltram Corporation's balance sheet and income statement

Q247: Vanik Corporation currently has two divisions which

Q252: Inscho Corporation manufactures numerous products, one of

Q323: Marbry Corporation has provided the following information

Q376: Gordon Corporation produces 1,000 units of a