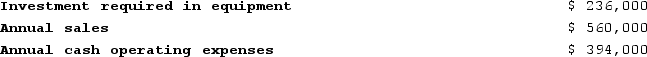

Chene Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $59,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $59,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

Definitions:

Market Index

A statistical measure that tracks the performance of a group of stocks, representing a portion of the overall market.

Correlation Coefficient

An analytical tool that determines the magnitude of association between the fluctuations of two interrelated variables.

Standard Deviation

A measure of the amount of variation or dispersion in a set of values, often used to quantify the volatility of a financial instrument or investment portfolio.

Stock-index Mutual Fund

A mutual fund that mimics the composition and performance of a particular stock market index, allowing investors to invest in the performance of the whole market or specific sectors.

Q79: The change in each of Kendall Corporation's

Q135: Reye Corporation has provided the following information

Q152: The Bharu Violin Corporation has the capacity

Q165: When a company pays cash to repurchase

Q167: Anthony operates a part time auto repair

Q175: It is profitable to continue processing joint

Q205: Antinoro Corporation has provided the following information

Q224: Goergen Corporation is considering a capital budgeting

Q334: All cash inflows are taxable.

Q350: The assumption that the cash flows from