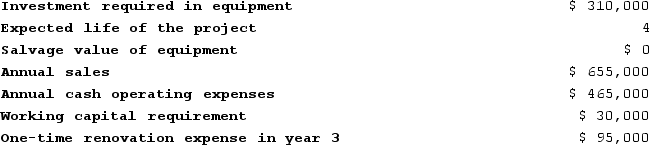

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

Definitions:

Credit Policy

Guidelines that define the credit limits and terms extended by a business to its customers.

Percentage of Receivables Basis

A method for estimating uncollectible accounts by applying a fixed percentage to the total receivables balance.

Cash Realizable Value

The amount of money that can be received from an asset when it is liquidated or sold.

Bad Debt Expense

A recognized expense that represents accounts receivable that are not expected to be collected.

Q4: Joetz Corporation has gathered the following data

Q92: The management of Lanzilotta Corporation is considering

Q118: The changes in each balance sheet account

Q130: Slomkowski Corporation is contemplating purchasing equipment that

Q144: Bonomo Corporation has provided the following information

Q145: Shimko Corporation's most recent comparative balance sheet

Q165: When a company pays cash to repurchase

Q222: Kestner Corporation has provided the following financial

Q272: An investment project with a profitability index

Q309: Welch Corporation is planning an investment with