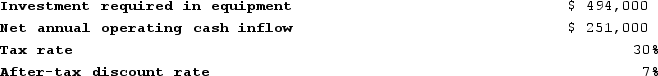

Rapozo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $164,667 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.Required:Determine the net present value of the project. (Round intermediate calculations and final answer to the nearest dollar amount.)

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $164,667 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.Required:Determine the net present value of the project. (Round intermediate calculations and final answer to the nearest dollar amount.)

Definitions:

Merchandising Company

A business that purchases finished goods for resale in order to earn a profit, without transforming these goods.

Wholesale Parts Company

A business entity that specializes in purchasing and selling automotive, machinery, or electronic parts in large quantities at lower prices, primarily to retailers or repair shops rather than end consumers.

Candy Store

A retail establishment specializing in the sale of candies, chocolates, and often other sorts of confections and sweets.

Moving Company

A business that provides services to transport furniture, equipment, and other belongings from one location to another.

Q8: The internal rate of return method assumes

Q161: Correll Corporation is considering a capital budgeting

Q190: Prosner Corporation manufactures three products from a

Q198: Salsedo Corporation's balance sheet and income statement

Q216: In a sell or process further decision,

Q271: When a company is involved in more

Q287: Stomberg Corporation has provided the following data

Q310: How much would you have to invest

Q313: Purvell Corporation has just acquired a new

Q397: The management of Elamin Corporation is considering