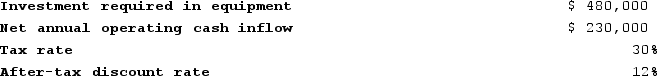

Condo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Definitions:

Menstruating

The monthly process in which the female body sheds the lining of the uterus, resulting in bleeding from the vagina.

Anorexia Nervosa

An eating disorder characterized by an obsessive fear of gaining weight, leading to severe restriction of food intake and emaciation.

Hiatal Hernias

A condition where part of the stomach pushes up through the diaphragm muscle into the chest cavity, often causing heartburn.

Cardiovascular Complications

Health problems related to the heart and blood vessels, often resulting from conditions like hypertension, diabetes, or lifestyle choices.

Q75: Woodridge Corporation manufactures numerous products, one of

Q123: The most recent comparative balance sheet of

Q163: A preference decision in capital budgeting:<br>A) is

Q165: Shanks Corporation is considering a capital budgeting

Q211: The management of Rademacher Corporation is considering

Q214: Boynes Corporation is considering a capital budgeting

Q222: The higher the discount rate, the higher

Q367: The Carter Corporation makes products A and

Q383: Wermers Industries Incorporated has developed a new

Q394: The Wester Corporation produces three products with