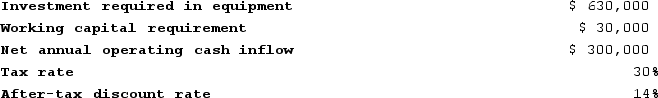

Ariel Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Definitions:

Interpretation of Causation

The process of understanding or explaining the reasons behind events or conditions, typically in the context of identifying why a particular disease or condition occurred.

Research Design

The overall strategy that a researcher employs to integrate the different components of the study in a coherent and logical way, ensuring the study addresses the research problem effectively.

Meta-analysis

A statistical technique that combines the results of multiple scientific studies to identify patterns, discrepancies, or the effectiveness of treatments.

Transactional Analysis

A psychological theory and therapeutic method that examines interactions and transactions between people to understand and improve communication and relationships.

Q8: Garson, Incorporated produces three products. Data concerning

Q118: The management of Penfold Corporation is considering

Q145: Shimko Corporation's most recent comparative balance sheet

Q163: Younes Incorporated manufactures industrial components. One of

Q170: Cabebe Corporation manufactures numerous products, one of

Q196: Mulford Corporation has provided the following information

Q251: Becker Billing Systems, Incorporated, has an antiquated

Q266: Denny Corporation is considering replacing a technologically

Q350: The assumption that the cash flows from

Q392: Lafromboise Corporation has provided the following information