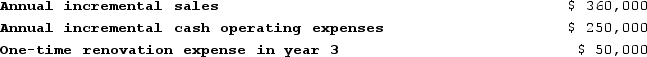

Yau Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with a 4 year useful life and zero salvage value. Data concerning that project appear below:

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 9%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 9%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Definitions:

Technical Information

Pertains to detailed data or knowledge that is specific to a particular subject, technology, or field that requires specialized understanding.

Facts and Figures

Concrete data and statistical information used to support arguments, inform decisions, or clarify situations.

Conflict Between

A situation where opposing ideas, interests, or individuals interact, leading to tension, disagreements, or disputes that need to be resolved.

Win-lose Approach

A competitive strategy that focuses on achieving a victory or advantage at the expense or loss of the opponent.

Q8: The internal rate of return method assumes

Q36: The management of Bonga Corporation is considering

Q130: In value-based pricing, the economic value to

Q214: Boynes Corporation is considering a capital budgeting

Q229: Mulford Corporation has provided the following information

Q236: The following information relates to next year's

Q260: Fabri Corporation is considering eliminating a department

Q350: Companies often allocate common fixed costs among

Q380: Patenaude Corporation has provided the following information

Q397: Two products, QI and VH, emerge from