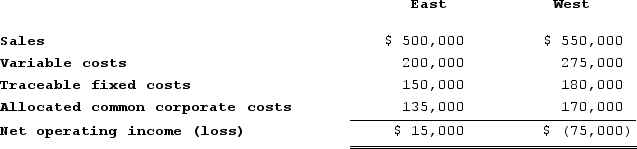

The Cook Corporation has two divisions-East and West. The divisions have the following revenues and expenses:  The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of:

The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of:

Definitions:

Compounded Quarterly

Calculation of interest on an investment or loan on a quarterly basis, leading to interest being added to the principal, which then earns additional interest.

Deposit Monthly

Refers to putting a certain amount of money into a financial account or investment regularly every month.

Goal

An objective or desired result that a person or a system envisions, plans, and commits to achieve.

Compounded Semi-annually

A method of calculating interest in which interest is compounded to the principal amount semi-annually.

Q32: Decelle Corporation is considering a capital budgeting

Q110: Shoun Mechanical Corporation has developed a new

Q135: Which of the following would be classified

Q152: The Bharu Violin Corporation has the capacity

Q236: The following information relates to next year's

Q245: The internal rate of return method assumes

Q289: Product X-547 is one of the joint

Q345: Condo Corporation has provided the following information

Q346: Product U23N has been considered a drag

Q401: Wallen Corporation is considering eliminating a department