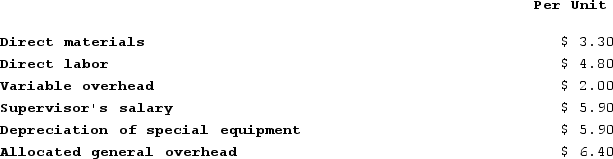

Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 14,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $26.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.In addition to the facts given above, assume that the space used to produce part U98 could be used to make more of one of the company's other products, generating an additional segment margin of $44,200 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product?

An outside supplier has offered to produce and sell the part to the company for $26.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.In addition to the facts given above, assume that the space used to produce part U98 could be used to make more of one of the company's other products, generating an additional segment margin of $44,200 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Stockout Cost

The cost incurred when inventory is not available to meet demand.

Inventory Holding Cost

The total cost associated with storing unsold goods or materials, including warehousing, insurance, depreciation, and opportunity costs.

Overtime

The time worked beyond the standard hours defined by the employer, often compensated at a higher pay rate.

Transportation Model

A type of mathematical model used in logistics that aims to minimize the cost of distributing products from several suppliers to numerous consumers, optimizing routes and supply chains.

Q11: A customer has asked Lalka Corporation to

Q27: Which of the following measures of performance

Q28: Morr Logistic Solutions Corporation has developed a

Q35: Crowl Corporation is investigating automating a process

Q97: Sardi Incorporated is considering whether to continue

Q131: Alway Candy Corporation is implementing a target

Q191: WP Corporation produces products X, Y, and

Q226: An avoidable cost is a sunk cost

Q250: Ramson Corporation is considering purchasing a machine

Q381: Boggess Corporation manufactures numerous products, one of