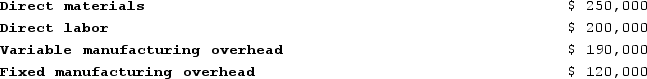

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:  Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.If Melbourne decides to purchase the subcomponent from the outside supplier, the annual financial advantage (disadvantage) would be:

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.If Melbourne decides to purchase the subcomponent from the outside supplier, the annual financial advantage (disadvantage) would be:

Definitions:

Closing Rate

The exchange rate at the balance sheet date used to convert foreign currency denominated financial statements into the presentation currency.

Functional Currency

The currency of the primary economic environment in which an entity operates, typically used in its financial reporting.

Historical Cost

The original monetary value of an asset or investment at the time of its purchase, not adjusted for inflation or other factors over time.

Current Rate Method

In accounting, a method for converting the financial statements of a foreign subsidiary to the parent company's currency by applying the current exchange rate to all assets, liabilities, equity, income, and expenses.

Q25: Nessen Corporation has provided the following information

Q35: Chruch Corporation manufactures numerous products, one of

Q55: Marbry Corporation has provided the following information

Q85: Ahrends Corporation makes 60,000 units per year

Q104: Mae Refiners, Incorporated, processes sugar cane that

Q129: Mercer Corporation estimates that an investment of

Q130: Financial measures tend to be lag indicators

Q157: The Freed Corporation produces three products, X,

Q198: Buzby Corporation manufactures numerous products, one of

Q200: Lafromboise Corporation has provided the following information