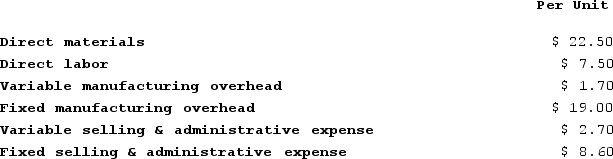

Elfalan Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 80,000 units per month is as follows:  The normal selling price of the product is $67.80 per unit.An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.90 less per unit on this order than on normal sales.Direct labor is a variable cost in this company.What is the contribution margin per unit on normal sales? (Round your intermediate calculations to 2 decimal places.)

The normal selling price of the product is $67.80 per unit.An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.90 less per unit on this order than on normal sales.Direct labor is a variable cost in this company.What is the contribution margin per unit on normal sales? (Round your intermediate calculations to 2 decimal places.)

Definitions:

Warranty Expense

Costs associated with the obligation to repair or replace products within a specified period due to defects or malfunctions, recognized as a liability on the balance sheet.

Repairs

Expenses incurred to restore an asset to a condition where it can be effectively used.

Warranty Expense

Costs incurred by a company to repair, replace, or service products due to manufacturing defects or failures during the warranty period.

Repairs

Expenditures to restore an asset to its former condition or to keep it in operable condition without increasing its life or value significantly.

Q37: If transfer prices are to be based

Q44: An increase in appraisal costs in a

Q49: Worsell Incorporated reported the following results from

Q76: Ralph Plastics Equipment Corporation has developed a

Q106: The Jabba Corporation manufactures the "Snack Buster"

Q132: Rollans Corporation has provided the following information

Q182: Planas Corporation has provided the following information

Q183: Weitman Corporation manufactures numerous products, one of

Q220: Supler Corporation produces a part used in

Q269: Benjamin Company produces products C, J, and