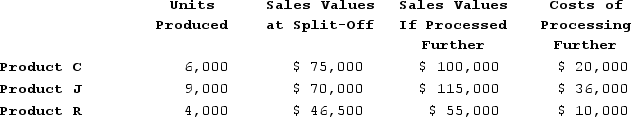

Benjamin Company produces products C, J, and R from a joint production process. Each product may be sold at the split-off point or processed further. Joint production costs of $95,000 per year are allocated to the products based on the relative number of units produced. Data for Benjamin's operations for last year follow:

Required:

Required:

Which products should be processed beyond the split-off point?

Definitions:

Variable Costing

A bookkeeping procedure that adds only variable production fees (including direct materials, direct labor, and variable manufacturing overhead) into the costs associated with products.

Unit Product Cost

The total cost to produce a single unit of product, including direct materials, direct labor, and allocated overhead.

Direct Labor Cost

The expense of labor that can be directly attributed to the production of goods or services.

Net Operating Income

A company's revenue minus its operational direct and indirect costs, excluding taxes and interest.

Q33: Saalfrank Corporation is considering two alternatives that

Q42: Kinsi Corporation manufactures five different products. All

Q53: Weafer Incorporated reported the following results from

Q80: Fregozo Products, Incorporated, has a Connector Division

Q111: Which of the following would be classified

Q124: Dock Corporation makes two products from a

Q188: Russnak Corporation is investigating automating a process

Q240: An automated turning machine is the current

Q390: Mcniff Corporation makes a range of products.

Q417: The SP Corporation makes 33,000 motors to