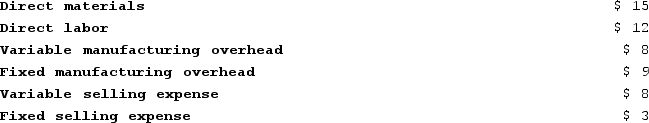

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:  The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. If Mowen Corporation offers to buy the special order units at $65 per unit, the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. If Mowen Corporation offers to buy the special order units at $65 per unit, the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Q31: Cabe Corporation uses a discount rate of

Q43: Ecob Corporation uses the absorption costing approach

Q81: Swagger Corporation purchases potatoes from farmers. The

Q91: Beery Incorporated reported the following results from

Q99: Chiodini Incorporated has a $900,000 investment opportunity

Q218: Companies that use value-based pricing establish selling

Q226: Correll Corporation is considering a capital budgeting

Q319: Ursus, Incorporated, is considering a project that

Q326: Last year a company had sales of

Q340: Suddeth Corporation has entered into a 6