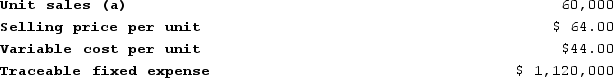

Chruch Corporation manufactures numerous products, one of which is called Tau-42. The company has provided the following data about this product:  Management is considering decreasing the price of Tau-42 by 6%, from $64.00 to $60.16. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Tau-42 earn at a price of $60.16 if this sales forecast is correct?

Management is considering decreasing the price of Tau-42 by 6%, from $64.00 to $60.16. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Tau-42 earn at a price of $60.16 if this sales forecast is correct?

Definitions:

Interest Rate Risk

The potential for investment losses due to fluctuations in interest rates that affect the value of interest-bearing assets.

Real Rate

The interest rate adjusted for inflation, reflecting the real cost of funds to the borrower and the real yield to the lender.

Dirty Price

The price of a bond that includes accrued interest in addition to the bond's face value.

Yield to Maturity

The total return anticipated on a bond if the bond is held until it matures, including all interest payments and the repayment of principal.

Q3: Marvel Corporation estimates that the following costs

Q112: The Consumer Products Division of Goich Corporation

Q113: The corporate social responsibility measure of "Percent

Q121: Perwin Corporation estimates that an investment of

Q184: Wamsley Products, Incorporated, has a Transmitter Division

Q230: The following data are for the Akron

Q271: When a company is involved in more

Q274: Cranston Corporation makes four products in a

Q306: Shilt Corporation is considering a capital budgeting

Q416: Management of Thebeau, Incorporated, is considering a