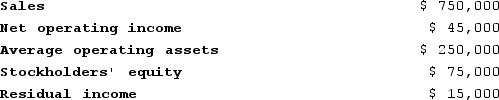

The following data are for the Akron Division of Consolidated Rubber, Incorporated:  For the past year, the turnover used in return on investment calculations was:

For the past year, the turnover used in return on investment calculations was:

Definitions:

Unit Product Cost

The calculated expense for producing a single unit, taking into account all costs of production from raw materials to finished goods.

Unit Product Cost

The total cost, including materials, labor, and overhead, to produce a single unit of a product.

Activity-Based Costing

Activity-based costing is a method of assigning indirect costs to products and services based on the activities they require.

Predetermined Overhead Rate

A calculated rate used to allocate manufacturing overhead costs to products based on a certain activity base like labor hours or machine hours.

Q54: Miguez Corporation makes a product with the

Q58: Paluso Corporation manufactures numerous products, one of

Q59: Wetherald Products, Incorporated, has a Pump Division

Q68: Minden Corporation estimates that the following costs

Q105: Throughput time is the amount of time

Q190: Residual income is the difference between net

Q267: Puvo, Incorporated, manufactures a single product in

Q272: Alway Candy Corporation is implementing a target

Q278: Wollan Corporation has two operating divisions-an East

Q376: Karim Corporation uses a standard cost system