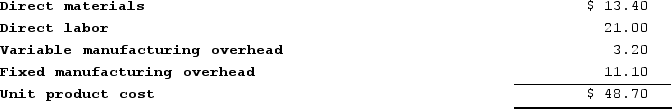

Foto Company makes 12,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $42.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $37,200 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.Required:a. How much of the unit product cost of $48.70 is relevant in the decision of whether to make or buy the part? (Round "Per Unit" to 2 decimal places.)b. What is the financial advantage (disadvantage) of purchasing the part rather than making it?c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 12,000 units required each year? (Round "Per Unit" to 2 decimal places.)

An outside supplier has offered to sell the company all of these parts it needs for $42.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $37,200 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.Required:a. How much of the unit product cost of $48.70 is relevant in the decision of whether to make or buy the part? (Round "Per Unit" to 2 decimal places.)b. What is the financial advantage (disadvantage) of purchasing the part rather than making it?c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 12,000 units required each year? (Round "Per Unit" to 2 decimal places.)

Definitions:

Internal Control

A process designed to ensure the reliability of financial reporting, compliance with laws and regulations, and effective and efficient operations.

Monitoring

Involves the continual oversight of activities, processes, or systems to ensure they are functioning correctly and achieving desired outcomes.

Business Goals

The objectives that a company aims to achieve, which guide its strategic planning and operational activities.

Compliance

Adherence to laws, regulations, guidelines, and specifications relevant to business operations.

Q24: Rebelo Corporation is presently making part E07

Q86: Ibsen Company makes two products from a

Q93: For management to be effective, it should

Q119: Kinsley Corporation manufactures numerous products, one of

Q158: Othman Incorporated has a $800,000 investment opportunity

Q262: Hady Corporation is considering purchasing a machine

Q267: Parsa Incorporated reported the following results from

Q326: Fixed costs may be relevant in a

Q328: Holton Company makes three products in a

Q330: Stokan Products, Incorporated, has a Antennae Division