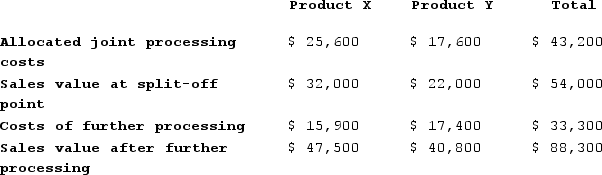

Ibsen Company makes two products from a common input. Joint processing costs up to the split-off point total $43,200 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

Required:a. What is financial advantage (disadvantage) of processing Product X beyond the split-off point?b. What is financial advantage (disadvantage) of processing Product Y beyond the split-off point?c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Required:a. What is financial advantage (disadvantage) of processing Product X beyond the split-off point?b. What is financial advantage (disadvantage) of processing Product Y beyond the split-off point?c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Nonrival

A characteristic of a good whereby one person's consumption does not diminish the availability of that good for consumption by others.

Television Programs

Scheduled content broadcasted on television, including series, movies, news, and other forms of entertainment or information.

Exclusion

The act of denying someone's access to a particular resource or activity.

Common Resource

A type of good that is non-excludable and rivalrous, such as fish stocks in the ocean; it is available to all but can be depleted by excessive use.

Q34: Rotan Corporation keeps careful track of the

Q59: Wetherald Products, Incorporated, has a Pump Division

Q62: Costs that can be eliminated in whole

Q74: Bonilla Incorporated has a $700,000 investment opportunity

Q90: Agustin Industries is a division of a

Q216: Ganus Products, Incorporated, has a Relay Division

Q256: Attal Corporation manufactures numerous products, one of

Q351: The management of Woznick Corporation has been

Q392: The management of Giammarino Corporation is considering

Q408: Sunk costs and future costs that do