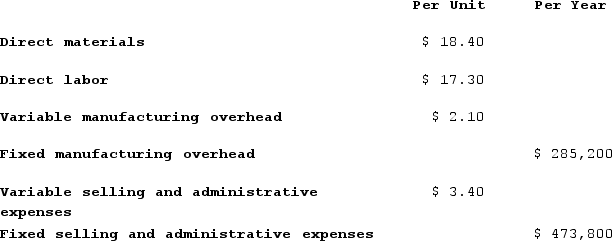

Quamma Corporation makes a product that has the following costs:

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 23,000 units per year.The company has invested $280,000 in this product and expects a return on investment of 8%.Required:a. Compute the markup on absorption cost.b. Compute the selling price of the product using the absorption costing approach.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 23,000 units per year.The company has invested $280,000 in this product and expects a return on investment of 8%.Required:a. Compute the markup on absorption cost.b. Compute the selling price of the product using the absorption costing approach.

Definitions:

FUTA Tax

The tax imposed by the Federal Unemployment Tax Act, paid by employers to support state employment agencies.

SUTA Tax

State Unemployment Tax Act tax, which is a state-based tax that employers pay to fund the unemployment benefits for workers who lose their jobs.

Sales Taxes Payable

Liability accounts that record the sales tax collected from customers on behalf of governmental authorities, to be paid in the future.

Q18: Vandenheuvel Corporation keeps careful track of the

Q30: Part U16 is used by Mcvean Corporation

Q31: The Downstate Block Company has a trucking

Q32: Boney Corporation processes sugar beets that it

Q33: Adolphson Corporation has provided the following summary

Q100: Jim Bingham is considering starting a small

Q184: Wamsley Products, Incorporated, has a Transmitter Division

Q212: Target costing involves adding a target profit

Q254: Morice Industries Incorporated has developed a new

Q305: Bellini Robotics Corporation has developed a new