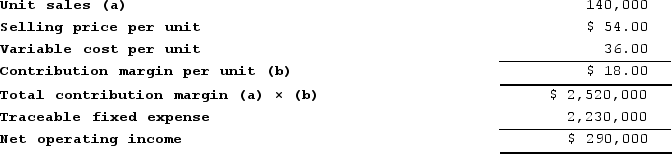

Cabebe Corporation manufactures numerous products, one of which is called Omicron55. The company has provided the following data about this product:

Required:

Required:

a. Management is considering decreasing the price of Omicron55 by 4%, from $54.00 to $51.84. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 140,000 units to 154,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Omicron55 earn at a price of $51.84 if this sales forecast is correct?

b. Assuming that the total traceable fixed expense does not change, if Cabebe decreases the price of Omicron55 to $51.84, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $54.00? (Round your answer to the nearest one-tenth of a percent.)

Definitions:

Return on Total Assets

A financial ratio that measures a company's profitability in relation to its total assets, indicating how effectively a company uses its assets to generate profit.

Semiannual Interest Payment

A finance term referring to the practice of making interest payments twice a year on a loan or bond.

Bonds

Debt instruments signifying an investment made by an investor in the form of a loan to either a corporation or a government entity.

Journal Entries

Records of financial transactions in the books of accounts, acting as the primary source for all accounting processes.

Q42: Which of the following performance measures will

Q44: HI Corporation is considering the purchase of

Q65: Marsdon Company has an annual production capacity

Q73: Royal Products, Incorporated, has a Connector Division

Q87: Otool Incorporated is considering using stocks of

Q235: Tavis Robotics Corporation has developed a new

Q303: Gallatin, Incorporated, has assembled the estimates shown

Q320: Parsa Incorporated reported the following results from

Q323: Juliani Company produces a single product. The

Q346: Joanette, Incorporated, is considering the purchase of