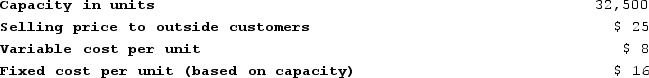

Ganus Products, Incorporated, has a Relay Division that manufactures and sells a number of products, including a standard relay that could be used by another division in the company, the Electronics Division, in one of its products. Data concerning that relay appear below:  The Electronics Division is currently purchasing 4,550 of these relays per year from an overseas supplier at a cost of $22 per relay.Assume that the Relay Division is selling all of the relays it can produce to outside customers. Also assume that $5 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Relay and Electronics Division financially better off than if the Electronics Division were to continue buying its relays from the outside supplier?

The Electronics Division is currently purchasing 4,550 of these relays per year from an overseas supplier at a cost of $22 per relay.Assume that the Relay Division is selling all of the relays it can produce to outside customers. Also assume that $5 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Relay and Electronics Division financially better off than if the Electronics Division were to continue buying its relays from the outside supplier?

Definitions:

Diesel Powered

Describes vehicles, machinery, or generators that operate using diesel fuel, which is known for its efficiency and torque output.

Cab/Bunk Heating

A system used to maintain a comfortable temperature inside the cabin and sleeping area of a truck or semi-trailer.

Security Market Line

A line that represents the relationship between the risk of an investment and its expected return, used in the Capital Asset Pricing Model.

Fairly Priced

A term used to denote that an asset's market price is considered reasonable based on its earnings and growth prospects.

Q17: Which of the following would be classified

Q18: Ulrich Company has a Castings Division which

Q27: Suver Corporation has a standard costing system.

Q57: Santoyo Corporation keeps careful track of the

Q78: The management of International Cookwares believes that

Q86: Ibsen Company makes two products from a

Q98: Largo Company recorded for the past year

Q147: Lumpkins Products, Incorporated, has a Valve Division

Q251: Division A makes a part with the

Q306: The Millard Division's operating data for the