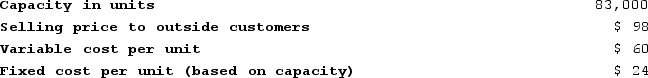

Delemos Products, Incorporated has a Transmitter Division that manufactures and sells a number of products, including a standard transmitter. Data concerning that transmitter appear below:  The Remote Devices Division of Delemos Products, Incorporated needs 6,000 special heavy-duty transmitters per year. The Transmitter Division's variable cost to manufacture and ship this special transmitter would be $66 per unit. Because these special transmitters require more manufacturing resources than the standard transmitter, the Transmitter Division would have to reduce its production and sales of standard transmitters to outside customers from 83,000 units per year to 76,400 units per year. From the standpoint of the Transmitter Division, what is the minimal acceptable transfer price for the special transmitters for the Remote Devices Division?

The Remote Devices Division of Delemos Products, Incorporated needs 6,000 special heavy-duty transmitters per year. The Transmitter Division's variable cost to manufacture and ship this special transmitter would be $66 per unit. Because these special transmitters require more manufacturing resources than the standard transmitter, the Transmitter Division would have to reduce its production and sales of standard transmitters to outside customers from 83,000 units per year to 76,400 units per year. From the standpoint of the Transmitter Division, what is the minimal acceptable transfer price for the special transmitters for the Remote Devices Division?

Definitions:

Predetermined Overhead Rate

A rate established in advance used to apply manufacturing overhead costs to products based on a certain activity base.

Fixed Overhead

Regular, unchanging costs associated with running a business, such as rent, salaries, and utilities, that do not fluctuate with production volume.

Work in Process

Refers to the cost of the unfinished goods in the manufacturing process including labor, material, and overhead.

Materials Price Variance

The difference between the actual cost of direct materials and the standard cost multiplied by the actual quantity purchased or used.

Q21: Poorly trained workers could have an unfavorable

Q51: The Global Reporting Initiative (GRI) is a

Q99: Ritner Corporation manufactures a product that has

Q119: Anguiano Incorporated reported the following results from

Q139: Division P of the Nyers Company makes

Q246: Tavis Robotics Corporation has developed a new

Q344: Neuhaus Corporation manufactures one product. It does

Q362: Majer Corporation makes a product with the

Q376: Karim Corporation uses a standard cost system

Q467: Phann Corporation manufactures one product. It does