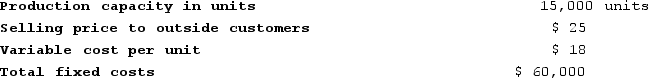

Division A makes a part with the following characteristics:  Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.Suppose that Division A is operating at capacity and can sell all of its output to outside customers at its usual selling price. If Division A agrees to sell the parts to Division B at $24 per unit, the company as a whole will be:

Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.Suppose that Division A is operating at capacity and can sell all of its output to outside customers at its usual selling price. If Division A agrees to sell the parts to Division B at $24 per unit, the company as a whole will be:

Definitions:

Financial Covenants

Agreements between a borrower and lender setting specific financial ratios or milestones the borrower must maintain.

Minimum Financial Tests

Financial benchmarks or ratios a company must achieve or maintain to comply with certain agreements, often related to debt covenants.

Borrower Must

Obligations or conditions a borrower needs to fulfill as per the terms of the loan agreement.

Debt Covenants

Specific agreements entered into by a borrower and lender, included in the terms of a loan or bond issuance, which place restrictions on the borrower to protect the lender.

Q9: Camps Incorporated has a standard cost system.

Q103: Milar Corporation makes a product with the

Q112: Luma Incorporated has provided the following data

Q122: Macumber Corporation has two operating divisions-an Atlantic

Q124: Kingcade Corporation keeps careful track of the

Q151: Gauntlett Incorporated reported the following results from

Q159: Wehrs Corporation has received a request for

Q192: Cannata Corporation has two operating divisions--a North

Q203: Mangrum Corporation manufactures one product. It does

Q315: When a dispute arises over a transfer