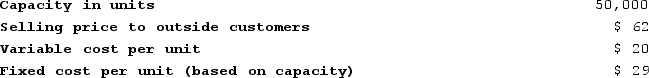

Ganus Products, Incorporated, has a Relay Division that manufactures and sells a number of products, including a standard relay that could be used by another division in the company, the Electronics Division, in one of its products. Data concerning that relay appear below:  The Electronics Division is currently purchasing 7,000 of these relays per year from an overseas supplier at a cost of $59 per relay.Assume that the Relay Division is selling all of the relays it can produce to outside customers. Does there exist a transfer price that would make both the Relay and Electronics Division financially better off than if the Electronics Division were to continue buying its relays from the outside supplier?

The Electronics Division is currently purchasing 7,000 of these relays per year from an overseas supplier at a cost of $59 per relay.Assume that the Relay Division is selling all of the relays it can produce to outside customers. Does there exist a transfer price that would make both the Relay and Electronics Division financially better off than if the Electronics Division were to continue buying its relays from the outside supplier?

Definitions:

Periodic Inventory System

An accounting method where inventory levels and cost of goods sold are updated at specific intervals, rather than continuously.

Transactions

Financial events or exchanges between parties that have a monetary impact on the financial statements of a business.

Adjusted Trial Balance

A list of all accounts and their balances after adjustments are made, used to prepare financial statements.

Year-End Closing Entries

Journal entries made at the end of an accounting period to prepare the accounts for the next period by clearing out revenues and expenses to the income summary.

Q21: Salvey Incorporated reported the following results from

Q122: Macumber Corporation has two operating divisions-an Atlantic

Q168: Wenner Corporation would like to use target

Q179: Phann Corporation manufactures one product. It does

Q207: Arena Corporation manufactures one product. It does

Q230: The Bowden Corporation makes a single product.

Q261: Fingado Products, Incorporated, has a Detector Division

Q328: Holton Company makes three products in a

Q458: The following data have been provided by

Q468: Glaab Incorporated has provided the following data