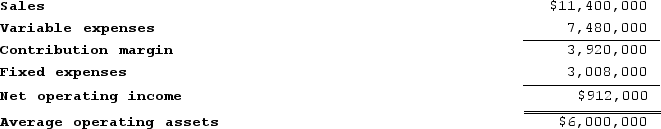

Ranallo Incorporated reported the following results from last year's operations:

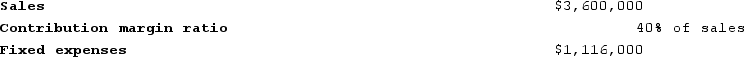

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

11. What was last year's residual income?

12. What is the residual income of this year's investment opportunity?

13. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

14. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

Definitions:

Miller-Orr Model

is a financial management strategy designed to optimize cash balances by setting upper and lower limits on cash reserves.

Weekly Cash Flows

An accounting measure used to monitor the cash movement in and out of a business on a weekly basis.

BAT Model

Behavioural Analysis Technology Model, used in various fields to anticipate or analyze human behavior; if not applicable, NO.

Opportunity Cost

The lost potential gain from other alternatives when one option is chosen.

Q17: For performance evaluation purposes, the fixed costs

Q86: Ibsen Company makes two products from a

Q97: Dews Corporation manufactures one product. It does

Q124: Freiling Corporation manufactures one product. It does

Q259: Viger Corporation has a standard cost system

Q278: Pleiss Corporation applies manufacturing overhead to products

Q310: Lakeside Nursing Home has two operating departments,

Q402: Hykes Corporation's manufacturing overhead includes $5.10 per

Q427: Lakatos Corporation manufactures one product. It does

Q443: Piper Corporation's standards call for 1,000 direct